SR22 Insurance: What Does It Cover?

SR22: What Is It?

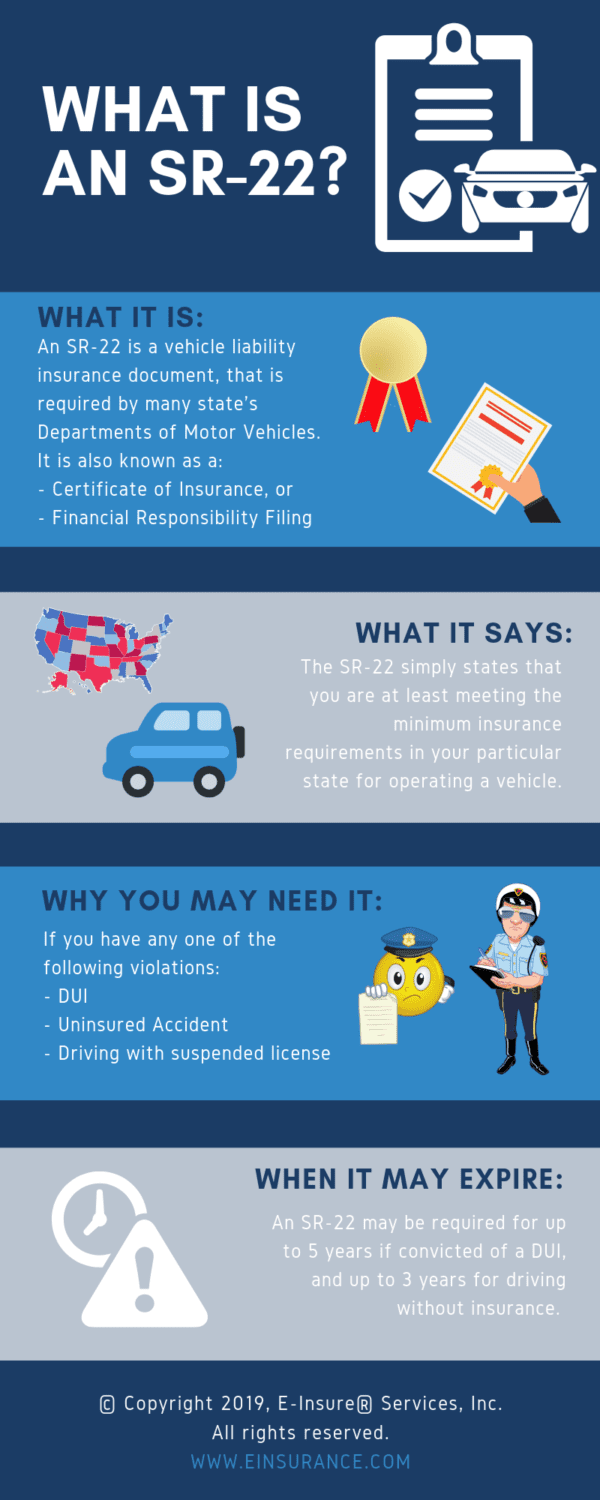

SR22 (also known as SR-22, SR 22, SR22 Form), is a vehicle liability insurance document required by most state department of motor vehicles (DMV) offices for “high-risk” insurance policies. SR-22 coverage means that you meet state’s auto insurance minimum requirements for driving and is NOT auto insurance itself.

Do I Need SR-22?

Each state has its own requirements, here are some examples that frequently require an SR-22:

- DUI or DWI

- At-fault accidents while driving without insurance

- Getting too many tickets in a short time period

- Driving with a suspended license

How Do I Get SR-22?

In general, simply indicating you are a driver needing SR 22 filing when purchasing your auto insurance policy. You can just add SR22 option in our online quote form to get it.

How Long Is SR-22 Valid?

Each state has its own requirements. Most states require drivers to have SR-22 coverage along with an insurance policy for about three years. As long as you pay the required premium and keep the policy active, the SR-22 will remain in effect until the requirements for your state have been met.

Check out our other article regarding SR22 Insurance Quotes or read our infographics below to learn more.

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE