Umbrella Insurance

Additional liability coverage to protect you from major claims.

Call Now: (866) 896-0049

Compare Quotes

Additional liability coverage to protect you from major claims.

Call Now: (866) 896-0049

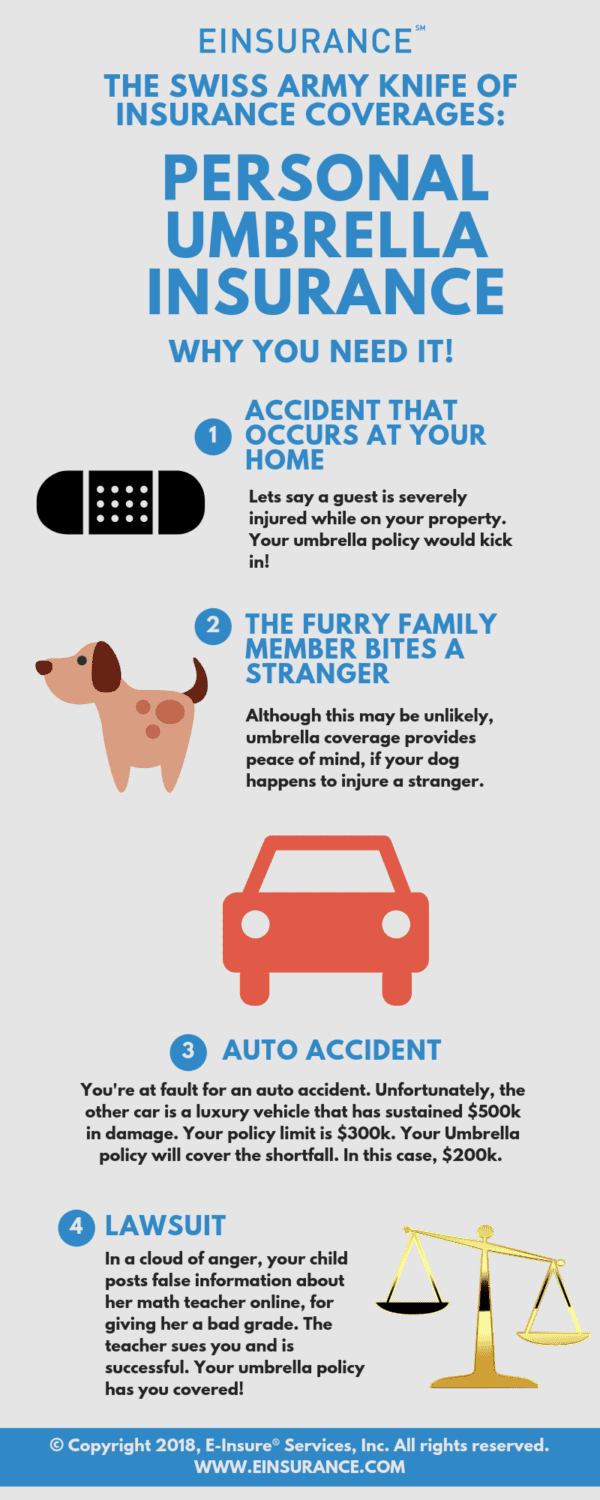

With a Personal Umbrella Insurance policy, you get an additional layer of liability coverage beyond that provided by your homeowner’s, auto, boat, and recreational vehicle policies. Personal Umbrella policies are extremely valuable due to the fact that they protect you, and your loved ones from unforeseen and tragic events that may reach limits that may exceed what your current policies offer.

Personal Umbrella Insurance is a relatively low-cost way to provide additional coverage if you’re sued for bodily injury or property damage beyond the limits of your existing policies. Coverage is usually issued in one million dollar increments, typically in the one to five million dollar range.

Personal Umbrella Insurance does not provide basic home, auto, boat, or RV coverage. It only kicks in when your current liability coverage limits have been reached, or there’s a gap in coverage with your current policy. Hence why Personal Umbrella Coverage is often referred to as ‘excess liability’ coverage.

In most instances, Personal Umbrella Insurance does not protect against business losses. Some homeowner’s policies may allow for certain exceptions to this rule for those who have a home-based business or a home office. If not, many insurance companies offer Commercial Umbrella Liability coverage.

In the past, usually only very wealthy individuals purchased Personal Umbrella Insurance. In our increasingly litigious society, however, more and more people of all income groups are considering it in order to protect their current assets and future earnings.

Personal Umbrella Coverage is for everyone! Whether you own multiple homes, rent a condo, or share a vehicle, it’s a great idea to add Personal Umbrella Coverage to your portfolio of insurance to provide peace of mind. In the unfortunate circumstance that you’re involved in an accident and found liable for damages that exceed your coverage limits; under normal circumstances, you would need to pay any remaining damages from out pockets, however, with Personal Umbrella Insurance, you’d be covered.

The following people are especially likely to benefit from Personal Umbrella insurance:

The basic question to ask yourself is whether you feel you have adequate liability coverage with your existing home and auto insurance policies. Keep in mind that both your current assets and future earnings could be stripped away by a single lawsuit.

Some insurers may require you to have home and auto coverage with them in order to extend additional Personal Umbrella Liability Insurance, or they may require you to satisfy certain liability coverage limits with your existing policies.

The cost of Personal Umbrella Insurance depends on your coverage limits; number of vehicles, residences, boats, etc. that you own; and your location. The average cost of a million dollars’ coverage is typically less than $200 per year.

Although considered the excess liability policy, Personal Umbrella Coverage is not a catch all insurance policy. While it does provide coverage for many gaps your current liability policies may have, and limits above those your current policy covers, it does carry exclusions. Items that are typically excluded include:

As you decide which carrier is best for you, make sure you compare different Personal Umbrella Policy rates and coverages in detail, as they can differ dramatically between insurance carriers.

Compare Insurance Quotes & Save