Terrorism Insurance Coverage

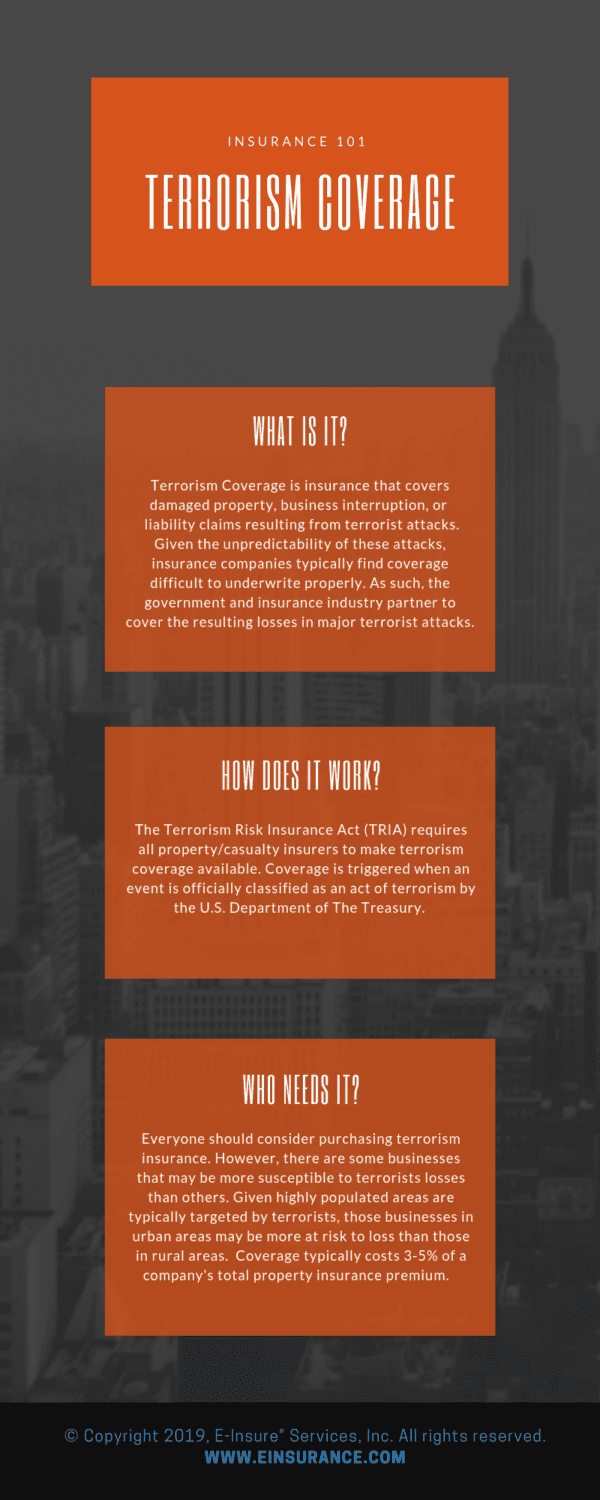

According to Wikipedia, terrorism insurance is insurance purchased by property owners to cover their potential losses and liabilities that might occur due to terrorist activities. It is a risk-sharing partnership between the federal government and the private insurance industry, created by the Terrorism Risk Insurance Act (TRIA) of 2002. It is often offered separately or as a special endorsement to your standard commercial property insurance policy coverage.

What Does Terrorism Insurance Cover?

Typical commercial terrorism policies cover damage or loss of buildings, equipment, inventory and furnishings. Some policies may cover attendant business interruption losses and/or liability claims. However, many terrorism coverage endorsements contain exclusions like nuclear, biological, chemical or radiological materials (NBCR) related events.

Each state regulates the insurance policies sold within its jurisdiction. So, depending on where you’re doing business, your terrorism insurance coverage might list specific exclusions such as fire following an attack, or cyber-attacks that don’t cause actual physical damage. You’ll need a separate cyber insurance policy for that.

If you have a terrorism insurance policy, any claim against it will have to meet certain criteria to qualify for reimbursement. That means the U.S. Department of the Treasury has to be officially declared an act of terrorism. The decision is based in part on intent of the perpetrators and the dollar amount of the aggregate damage caused.

If your business is located in a rural or primarily residential area, your risk of exposure is less than a business located in an urban center.

Whether you should buy terrorism coverage or not depends largely on your business location, insurance costs and type of business. Take a closer look and then decide if it is for you and your business.

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE