House Cleaning Insurance – What You Should Know as a Business Owner

Key Takeaways:

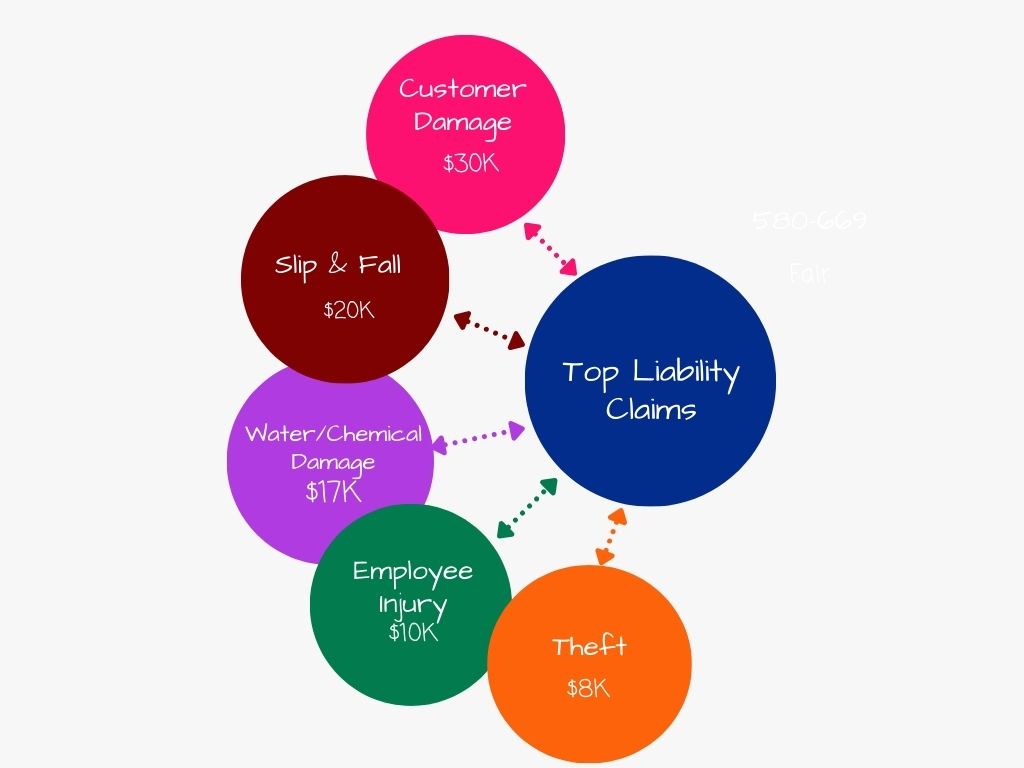

- House Cleaning Insurance is essential to protect you and your business from injury and property damage claims that can financially devastate your business—a single claim could cost you between $10K and $35K on average. Learn how to protect yourself.

- More than three quarters of customers say they will only hire a cleaning service that is insured and bonded. Find out what bundle of policies gives you maximum protection.

- House Cleaning Insurance is very affordable, especially in light of your financial exposure when defending a claim against you or your company.

Whether you own a house cleaning business, are thinking of starting one, or are looking to expand an existing business, House Cleaning Insurance is a critical component within the industry.

Think of House Cleaning Insurance as an umbrella of different types of insurance coverage that, together, create a safety net of protection for your business. It doesn’t matter if you are a sole proprietor or a corporation, you will want coverage that includes general liability insurance, workers’ compensation insurance, commercial auto insurance, and more. Without it, you leave yourself exposed to personal and professional financial risk should the unexpected happen.

So, Just How Big is the House Cleaning Market?

In the U.S., the residential cleaning services industry is valued at over $13 billion annually with a projected 6.5% growth rate through 2028. Driven by dual-income households and an aging population willing to pay for cleaning services, including services like specialized floor care and eco-friendly cleaning, the industry should continue to grow at a significant pace for the foreseeable future.

The vast majority of cleaning clients want to work with house cleaning companies that are bonded and insured for these reasons:

- Financial protection in case of accidents or mishaps

- Licensed, bonded and insured vendors show a commitment to professional standards

- Trustworthiness

- Peace of mind knowing the work will be done correctly

- Worker safety in case of injuries

While most states don’t require licensing for house cleaning companies, many do require a general business license. There may also be specialized licensing needed if you offer carpet cleaning, mold removal, or any form of pest control. Also, you will also need to check with local authorities who may have separate licensure requirements.

Understanding House Cleaning Insurance

House cleaning insurance is distinctly different from general small business insurance. While both protect the business, house cleaning insurance is tailored for the specialized activities that are part of residential cleaning and could result in:

- Injuries from moving heavy furniture or equipment, or slip and fall accidents, where according to the National Safety Council, workers are particularly vulnerable due to wet floors and unfamiliar spaces.

- Damaged or broken property, like furniture, rugs, lamps, kitchenware, or appliances.

- Injuries from Hazardous Materials like chemicals and cleaning fluids.

- Accusations of theft from a client.

As a business owner, it’s a great idea to have a dedicated insurance agent that can help you get the best policy bundles and who can answer any questions that you have about coverage, costs, etc. Using an online insurance expert, like einsurance.com can help you find the best options for you and your business.

Let’s take a look at the various types of insurance that are needed.

General Liability Insurance—Your First Line of Defense

Whether you own a major house cleaning business or are a solo-entrepreneur, you need General Liability Insurance. It is generally affordable (especially in relation to the potential costs associated with claims) and provides a comprehensive way to protect your business and personal assets as well as manage your risk.

1.Property Damage and Third-Party Injuries

Accidents happen – plain and simple. General Liability Insurance protects you from things like a client tripping over your equipment and injuring themselves, cleaning products being spilled on the hardwood floors and causing damage, or an antique lamp getting knocked over by accident.

By covering the costs of property damage and bodily injury claims, you are protecting your business and livelihood from high out-of-pocket costs.

Top Liability Claims in the Cleaning Industry

Source: The Hartford

2.Legal Claims Associated with Your House Cleaning Business

Your General Liability Insurance policy will help protect you if a customer initiates a lawsuit. Even if the customer’s claim are unfounded, legal costs can run into the thousands (or much more). Your insurance will help cover attorney fees, court costs, and any judgments or settlements that may arise.

3.Demonstrating Trustworthiness and Legitimacy

With a house cleaning business, clients are inviting you into the homes and asking you to take care when cleaning their possessions. They want to know whether the person or business they are using is professional and trustworthy. By having a General Liability insurance policy in force, you and your business are demonstrating a commitment to accountability.

Professional Liability Insurance

Professional Liability Insurance, or Errors and Omissions Insurance, protects your business from claims related to negligence, misrepresentation, breaches of contract, and material omissions.

This can also cover any violations of good faith or fair dealing or giving inaccurate advice or information to a client that results in a financial loss. And, although not common, it can provide protection against a breach of warranty, fraud, defamation, and even cybercrime.

Workers’ Compensation Insurance

Next in line, Workers’ Compensation Insurance is an essential component for house cleaning insurance coverage. Workers’ Compensation Insurance covers you and your employees in the event of an injury. It’s also mandated by most states if you have employees. If you are using independent contractors, they are required to carry their own insurance if they choose.

Workers’ Compensation Insurance covers:

- Medical expenses, such as doctors’ visits, hospital care, PT, OT, and rehabilitation care, prescriptions, etc.

- Lost wages for the employee while they’re out of work. NOTE: Well-managed Workers’ Compensation programs will want to get your employee back to work as soon as possible, even for ‘light or restricted’ duty. Medical outcomes are far better if the employee returns to work as promptly as possible.

- Costs of retraining and education if an employee is not able to return to their job.

- Legal costs to defend claims or lawsuits related to the injury.

- Death benefits for the family, including funeral costs, etc.

Additional Essential Coverage Options to Consider for a House Cleaning Business

1.Commercial Auto Insurance

If you transport employees and equipment to job sites or your employees use their own transportation, Commercial Auto Insurance can help provide coverage in the event of an accident, damage or theft.

In most cases, personal auto insurance usually won’t cover damage if the vehicle is being used exclusively for work. This is the same for health insurance when an injury is work-related. Insurance companies are hyper-aware of who’s responsible in the event of a claim.

2.Tools and Equipment Insurance

General Liability Insurance doesn’t cover your tools or equipment, so you will need a Tools and Equipment Insurance policy to cover things like your vacuums, carpet cleaners, floor polishers, and the other various tools and equipment you may use to clean your clients’ homes.

3.Fidelity Bonds & Janitorial Bonds

Fidelity or Surety Bonds, as well as Janitorial Bonds, are a form of insurance that provides employee dishonesty coverage. If you have a client claim that something was stolen from their property, your bond will cover the cost up to the limits set by the policy.

4.Business Owner’s Policy

A Business Owner’s Policy, or BOP, is a bundle of insurance policies designed for small to medium businesses. It provides the coverage needed to protect you and your company against property and liability risks. BOPs usually include General Liability Insurance as well as property protection and other types of insurance policies to protect your assets, operations, and income.

How Much Does House Cleaning Insurance Cost?

Costs can vary depending on the size and scope of your business, which insurance company you select, and the type of insurance you want. Factors, such as your business size, number of employees, past claims, and service area, all figure into the costs as well.

Annual average insurance premiums for cleaning companies can range as follows for a small business:

- General Liability Insurance – $525 to $825

- Workers’ Compensation – $1,300 to $1,500

- Fidelity Bonds – $125 to $150

- Business Owner’s Policy – $75 to $200

Again, costs will vary greatly depending on the specifics of your business.

As you research house cleaning insurance, remember to request any discounts available. These may include discounts for bundling policies, having a clean history of claims, and demonstrating safe work practices.

How to Get House Cleaning Insurance that Match Your Needs

While it’s possible to work directly with an insurance carrier, utilizing an online marketplace, like einsurance.com, allows you to gather information from multiple companies and compare costs while also meeting with different agencies to find the best fit.

Let’s look at how you assess your needs in a step-by-step process so that you are prepared to make valid business decisions once you decide on a policy bundle:

1. Assess Your Risks

- How many clients do you have?

- How expensive are their homes (are your clients mainly in suburban neighborhoods, well-to-do or ultra-exclusive enclaves, or resort communities)?

- How many employees do you have, and do you require pre-employment screenings, e.g., drug testing, background checks?

- What types of equipment do you use and how do you transport the equipment and/or employees?

- How much time do you allow for cleaning jobs? Are employees rushed?

2. Getting a Quote

- Using a tool like einsurance.com, explore pricing and agents to find the best fit.

3. Compare Your Options

- Review pricing and also compare discounts and bundling recommendations.

4. Purchase Your Coverage and Review/Update Annually to Keep Your Coverage in Full Force

When weighing your provider options, be sure to compare industry experience, policy flexibility, discounts offered and claim responsiveness.

Compliance and Risk Management in the House Cleaning Industry

As part of an overall risk strategy for your business, house cleaning insurance is imperative when protecting your business and personal assets. Including a Certificate of Insurance to any contract let’s your clients know that you are committed to protecting your business and managing the risk that’s associated with working in a client’s home. It documents your professional approach right from the beginning.

Additionally, providing your team members with documented training on OSHA Standards and workplace safety within your industry can reduce claims and lower your premiums, while further enhancing your risk management efforts.

Building Your Business on Trust

When you have solid insurance coverage and a strong risk management outlook, it gives you a competitive edge and allows you to pursue work with large groups, e.g., real estate developers, agencies, corporate clients, and short-term vacation rentals (like Airbnb and VRBO).

By positioning your cleaning business as trustworthy, professional, and scalable, you signal to large companies that you are reliable and ready for a challenge.

Summing Up the Benefits of House Cleaning Insurance

From medium and small house cleaning businesses to solo-entrepreneurs, having good insurance coverage is crucial to protecting yourself and your business.

Start by examining your business to understand what levels of coverage best suit your business needs. Also, be sure you understand what’s required of you to do business—your state may have licensing and insurance requirements, so find out here.

House Cleaning Insurance is an investment in your reputation as well as a protective umbrella for your business. Speak to an insurance professional to get the most comprehensive information.

Contact einsurance.com for all your insurance needs—business and personal. You can compare quotes and find the best pricing from national brands.

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE