Cheap Car Insurance with Bad Credit

How to Get Cheap Car Insurance When You Have Bad Credit

It is not unusual to have a tough time keeping a good credit rating, especially during economic downturns. If you have bad credit scores it can affect your car insurance rates, raising them higher than you’d like. Take some comfort in knowing that you can still get cheap insurance regardless of your credit rating.

How Credit Scores Influence Insurance Rates

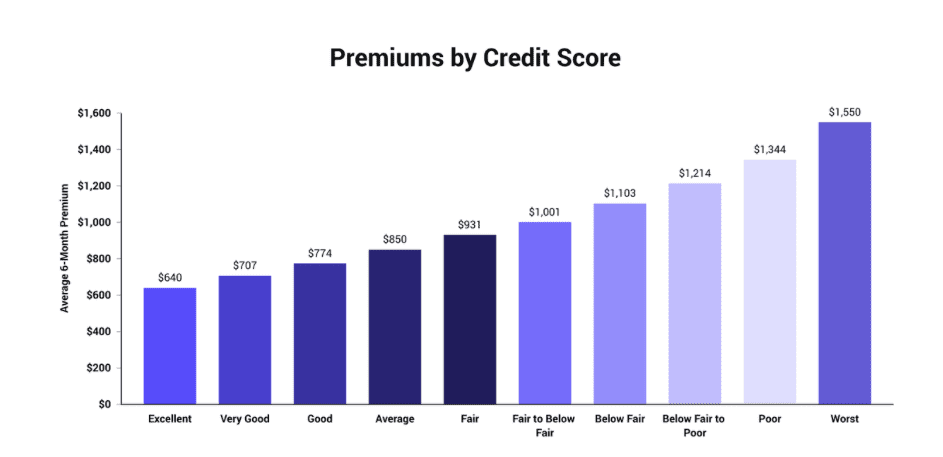

Credit scores are just one of the things that auto insurance companies use to set rates. Looking at their own historical data as well as information provided by the Federal Trade Commission, they have concluded that drivers with bad credit ratings file more claims on average than do drivers who have excellent credit scores.

Not only that, but the data show that when drivers with the poorest credit file a claim they tend to cost the insurance company more in payouts. Bottom line here is that drivers with better credit scores cost less to insure so their premiums are lower.

Source: The Zebra

Very Poor Credit vs. Very Good Credit

People with poor credit generally pay roughly $100 or more per month for a car insurance policy. A survey of eight insurance companies concludes that policies owned by a driver with very poor credit (a score of 300 to 579) cost 77 percent more than one owned by a driver with very good credit (a score of 740 to 799).

What Goes into Setting Premiums?

Insurance companies use a variety of factors when setting premiums including an insured’s:

- Age

- Driving history

- Credit history

- Years of driving experience

- Location

- Gender

- Insurance history

- Annual mileage

- Marital status

- Claims history

- Coverage level

- Type of vehicle

- Vehicle ownership status

- Discount options available

Not All States Use Credit Scores

If you have poor credit but live in California, Hawaii or Massachusetts, you can rest easy because these states do not allow insurance companies to use credit when setting rates.

In the rest of the nation you can find companies that do not use credit scores to determine how much you’ll be charged, but they are more likely to charge higher rates.

Ways to Save on Car Insurance When You Have Bad Credit

There are ways you may be able to lower the cost of your car insurance despite your poor credit.

- Apply for coverage with insurers that specialize in accepting drivers having a hard time getting policies from traditional providers.

- Increasing your deductible could lead to better rates, but make sure you can still afford to pay expenses after an accident.

- Carefully review your policy to find coverage that you can remove to save money. Be sure you meet your state’s car insurance minimum.

- If you’re with a traditional insurance company that sells different kinds of insurance, try bundling your car insurance with home and life insurance to receive a discount.

- Toe the line and don’t get any tickets or citations and you might be given a good driver discount.

- Insurance companies can offer coverage with discounts based on the insured’s line of work such as a medical professional, first responder, teacher, government employee or an engineer, for example.

- An affinity or membership discount is a one that is based on your membership in specific groups such as clubs, fraternities, sororities and business organizations.

Car Insurance Options When Your Credit is Bad

Usage-Based Car Insurance

If you don’t drive often or far on a regular basis and you have good driving habits, usage-based auto insurance is worth looking into because it might save you money. Instead of determining rates based on credit ratings, usage-based insurance uses personal driving habits to decide on rates.

Risky driving habits include things like:

- Accelerating rapidly

- Hard braking

With usage-based plans, the insurance company monitors your driving by either installing a device or using OnStar, Sync or another telematics service. These devices keep track of both how you drive as well as how many miles you drive.

If you have bad driving habits, this kind of insurance might consider you a risk and charge more than you wish.

No-Credit Insurance Policies

Seek out insurance providers who do not use credit ratings to determine your premium costs. If you live in California, Hawaii or Massachusetts, you’re set because these states specify that credit cannot be used to set insurance rates.

A no-credit policy might be a good choice if you’ve been denied coverage by other insurance companies but have a safe driving record.

Traditional Insurers Who Make Exceptions

If your credit rating was affected by certain life circumstances, and if you have a history of excellent driving and of making payments on time, many traditional insurance companies might take that into consideration and give you a lower rate. These factors include the following:

- Divorce

- Death of a spouse, parent or child

- Serious illness or injury

- Government-declared disasters

- Involuntary unemployment

- Military deployment

- Identity theft

How Bankruptcy Affects Car Insurance Premiums

If you have had to file for bankruptcy, it will probably edge you into the “risk” column for your auto insurance company. If you had a poor credit rating prior to bankruptcy, it could cause your insurance premiums to go up when you renew. But, if you had a good credit rating before the bankruptcy and have kept your insurance premium payments current, you might not see a rate increase.

Bankruptcy will be detrimental to your credit rating and it remains on your credit record for as many as ten years. When a car insurance provider looks at you as a risk, you’re likely to see an increase in premiums. If you look to purchase a new car insurance policy after bankruptcy, companies that see bankruptcy as a risk factor may decide not to even give you a quote.

How to Improve Your Credit-Based Insurance Score

To bring your credit rating up and possibly receive lower premiums from your credit-based insurance company, here are a few things you can do:

- Pay bills on time

- Keep credit card balances low

- Keep your number of credit cards low

- Establish and maintain good credit to build a decent credit history

- Keep an eye on your credit reports and if you see a mistake, report it

Over time you’ll improve your credit scores and probably enjoy lower premiums.

Going Forward

Learn more about getting cheap auto insurance here. Then, you can use the online tool to receive and compare quotes from insurance companies to find the best one that suits your need.

EINSURANCE

EINSURANCE

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE