What Happens If You Get Hit By an Uninsured Driver?

What Could Happen if You are Hit by an Uninsured Driver

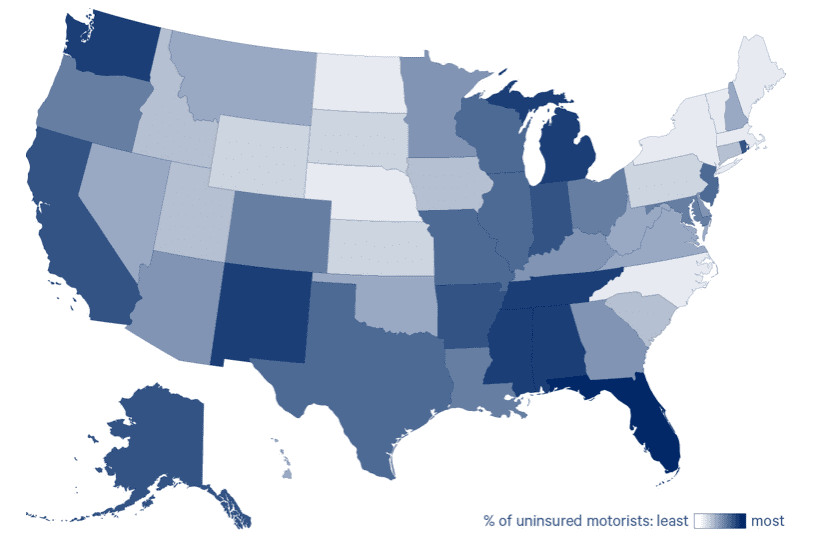

Did you know that, as of 2018, an average of 13 percent of drivers nationally do not have auto insurance? This despite the fact that car insurance is required at some level in almost all states. The percentage varies by state, with Florida having almost 27 percent of drivers who do not have auto coverage while Maine’s stats show only 4.5 percent.

What does this mean for you? If an at-fault driver in an accident is uninsured or underinsured, that driver can’t cover any damages you, your passengers and your car sustained.

You can protect yourself with uninsured motorist insurance (UMI) coverage. This insurance can protect you when the at-fault “other guy” doesn’t have the insurance, or enough insurance, to help pay for your damages to yourself, your passengers and your property from an accident.

What Is Uninsured Motorist Coverage?

There are three types of UMI coverages designed to protect you from damages caused by at-fault, uninsured drivers:

- UM Bodily Injury

- UM Property Damage

- Combination of the two policies into a single UMI

Insurance companies in most states must by law offer UMI policies, although only a few states do require drivers carry such coverage.

Uninsured Motorist Property Damage

Some states require you to carry UM property damage coverage, while other states stipulate that insurance companies must offer it. This kind of coverage would help pay the cost of repairing or replacing your damaged vehicle, or other damaged property. When you do purchase a property damage policy, it is important to make sure your coverage is high enough to replace your current vehicle.

Underinsured Motorists

If the at-fault drive in an accident does not carry does not carry auto liability coverage, your underinsured motorist insurance will pay the difference between the other driver’s insurance payments and how much you really need to cover all your costs for injuries, damage to your car and other losses due to the accident.

States That Require Uninsured/Underinsured Motorist Coverage

Twenty-four states, including the District of Columbia, stipulate that drivers must have UMI coverage.

- Connecticut

- District of Columbia

- Illinois

- Indiana

- Kansas

- Kentucky

- Maine

- Maryland

- Massachusetts

- Minnesota

- Missouri

- Nebraska

- New Hampshire

- New Jersey

- New York

- North Carolina

- North Dakota

- Oregon

- South Carolina

- South Dakota

- Vermont

- Virginia

- West Virginia

- Wisconsin

There are Limits

If you decide to protect yourself with an uninsured/underinsured motorist policy, which is usually inexpensive, you’ll find that most insurance companies will not let you carry more coverage than you have for liability. This rule was created out of a fear that customers might purchase the most basic of liability coverage and huge amounts of on uninsured/underinsured motorist coverage. The result of such a practice would be financial problems for insurance carriers.

What Are No-Fault Laws?

You have probably heard of no-fault laws. States with this kind of law require that both drivers’ insurance policies pay for that particular driver’s, and passengers’ injuries and damages. So, you would file a claim with your provider and the other drive would submit a claim to their own insurance carrier. Generally, in a no-fault state, you can’t sue the other driver unless you and your car sustained severe damages.

State-by-State Uninsured Motorist Rates

Recent data shows that the state with the highest rate of uninsured motorists is Florida, with an estimated rate of 26.7%. This makes sense considering Florida is the only state that doesn’t require drivers to have bodily injury liability insurance.

Maine has the fewest uninsured drivers per capita with just 4.5 percent. That is 65 percent lower than the national rate, 13 percent, as of 2015.

Percentage of Uninsured Drivers in Each State

The map below shows general percentage of uninsured motorist in each state, ranging from the darkest blue (higher numbers of uninsured drivers) to white for states that has the fewest percentage.

Source: ValuePenguin

A total of 24 states including the District of Columbia require drivers to carry uninsured motorist insurance

What Happens if You Drive Without Insurance?

If you don’t have auto insurance and get caught, the consequences will vary depending on which state you are in. You can incur fees, suspension of your license, vehicle impoundment or jail time. If, on top of driving without insurance you get into an accident you might be sued for damages and injuries by the other driver.

Examples of Penalties

Here’s a sampling of the penalties for insurance non-compliance in five different states:

| State | Fees | Driving privileges | Additional penalties |

| Florida | $150–$500 | Suspended license and registration for up to three years, unless proof of insurance is provided within five days | |

| Mississippi | $500 | License suspension for one year or until proof of insurance is provided | |

| New Mexico | $300 | Possible vehicle registration suspension | Up to 90 days of jail time |

| Michigan | $1,000 ($500 per year for two years) | Driver’s license suspended for up to 30 days | Up to one year of jail time. |

| Tennessee | $300 | Driver’s license suspension until you provide proof of financial responsibility |

Source: ValuePenguin

States Try to Lower the Rate of Uninsured Motorists

States are trying to reduce the rate of uninsured drivers. Let’s look at some examples.

Random Selection Programs

In Ohio, motorists must participate in a random selection program. Every week, a number of registered vehicle owners are selected at random. They must provide proof of insurance. Any drivers who don’t have insurance are then “suspended” for non-compliance. To get reinstated, non-compliant drivers must get insurance and provide proof as well as pay a fee. They must pay more fees and fulfill harsher reinstatement requirements if they continue the offense.

Insurance Verification systems

A verification program stipulates that insurance companies let the state transportation office when a policy lapses or is canceled. Law enforcement has access to the database of current insured vehicles, so it’s easier to identify uninsured drivers.

No Pay, No Play Laws

Eleven states have no pay, no play laws in place:

- Alaska

- California

- Indiana

- Iowa

- Kansas

- Louisiana

- Michigan

- Missouri

- New Jersey

- North Dakota

- Oregon

These states put a number of measures in place in an effort to reduce the number of uninsured motorists.

- When an uninsured motorist is in an accident with an insured driver who is at-fault, uninsured motorist is limited in what type of compensation they can receive.

- Many no pay, no play states limit uninsured drivers’ ability to sue for noneconomic reasons (such as pain and suffering) but do not limit them from being compensated for damages including medical bills or auto repairs.

Be Prepared

Adding uninsured motorist coverage to your auto insurance policy is the smart thing to do. Want to check out how much you might be able to save on insurance? Use our online tool to get quotes for comparison before making your final decision.

EINSURANCE

EINSURANCE

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE