8 Simple Ways to Save You 90% On Your Car Insurance

You may already know auto insurance premiums depend on many common factors like a vehicle’s make and model, drivers’ safety records, vehicle usage conditions and years of driving experience. However, you may not know there are many other hidden factors you can apply, yet you haven’t fully utilized them. EINSURANCE will tell you those 8 simple, but effective ways to save big on your car insurance premiums.

1. Check out if you own or rent your house

Research from Consumer Federation of America reported that the annual percentage difference between car insurance premiums for renters and homeowners ranges from $44 (4%) to $192 (13%). In some of the worst cases, good drivers will be charged 47% more if they don’t own their home. Compare quotes to see how much you can save on this one.

2. Find your credit score before you buy car insurance

Most insurance companies need information from you when they set your premiums. Your credit score is one of them. According to credit.com, 90% of insurance companies now take the “insurance risk score” system to determine how likely you will be involved in car accidents and file claims. They then set your premiums based on this information. There are many credit score companies like Transunion, Experian, and WalletHub. For WalletHub, they offer free credit scores and full credit reports updated on a daily basis.You can check your credit score quickly and take actions like paying off your loans, and keeping your balance low, to improve your credit score. This will help you a lot when applied to your car insurance.

3. Bundling, bundling, bundling

Some people may not want to have all their insurance policies with just one company. They may recall the finance quote “Don’t put all your eggs into one basket.” However, you should, and you’d better bundle your insurance, especially for home and auto. Progressive, Nationwide, Allstate, and several others have bundle discounts up to 35% for your car premiums. Sounds great? Go compare quotes now.

4. Review your car insurance policies periodically

People don’t realize that they usually pay for collision and comprehensive insurance all the time. If you don’t understand what collision and comprehensive coverage is, check what kind of auto insurance do you need? When you have an older car, you need to decide is it worth paying the higher premium to cover your car when accidents happen. For example, if you have a car worth $8,000, and you get into an accident that requires $5,000 repair fees, you may choose to opt out of collision or comprehensive coverage.

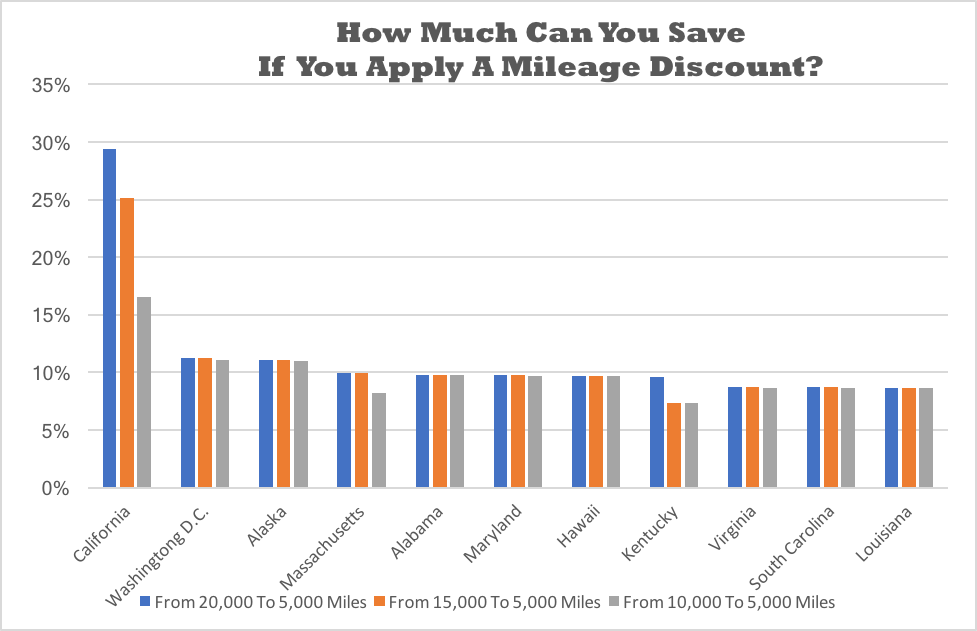

5. Apply low mileage discount to your car insurance premiums

According to the Federal Highway Administration, average Americans drive 13,476 miles annually. While you may not commute 20 miles per day, you are still eligible for low mileage discounts. Some people may ask, “How much can I really save?” Check out the savings for a few states below.

Source: Quadrant Information Services, April 2015

6. Don’t forget your group connection

You’ve attended and joined so many groups either professional, business or even alumni. Insurance companies tend to give big discounts for groups. You should investigate, as well as ask your employer, club or other membership group before you purchase car insurance. This one tip could help you save 25% or more on your car premium.

7. Moved? New zip code, new saving opportunity

Most people shop online to obtain quotes and are unaware of the huge difference in car insurance premiums between different areas. Based on an experiment done by bankrate.com, in Brooklyn, New York, there can be as much as a 58% increase in car insurance premiums for locations that are just 1.6 miles apart. So, when you move to a new place, don’t forget to check the insurance price in your new area and negotiate with your insurance company. What are you waiting for? Check now.

8. Young drivers’ saving tips

If you are between age 16 to 24, you are eligible to utilize some great discounts. First, if you are a full-time student, with a good academic record (average grade “B”), you could have as high as a 15% discount on your car premium. Second, if you complete a drivers’ education course, such as defensive driving course, you will earn a discount on most car coverages. You can check out more on Young Drivers Car Insurance and Cheap Car Insurance For a Young Driver.

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE