Cheap Car Insurance for New Drivers

Looking for Cheap Car Insurance for New Drivers? Start Here.

If you’re a new driver and need auto insurance coverage, keep in mind that when car insurance providers look at you, they see a risk. That’s because they provide coverage based on your risk profile. The higher the risk, the more expensive the coverage. And a brand-new driver is seen as high-risk. Still, there are steps that can be taken that can to help to find cheap car insurance for new drivers or young drivers.

Who Is the Typical New Driver?

Usually, new drivers are young people in their teens or early twenties. At this age, a younger driver is better off being on their parents’ car insurance policy. This will drive the parents’ premiums up, but relatively speaking, if the parents are covering costs for their child, it can be cheaper than the young person having a separate policy all his or her own.

Others who might need car insurance for the first time can also include immigrants and foreign nationals. Another category is people needing car insurance after a gap in coverage.

How Premium Costs Are Calculated

A lot of elements play into how premium rates are decided. Insurance providers base rates on a point system. Here’s a quick run-down of some of the key rating factors:

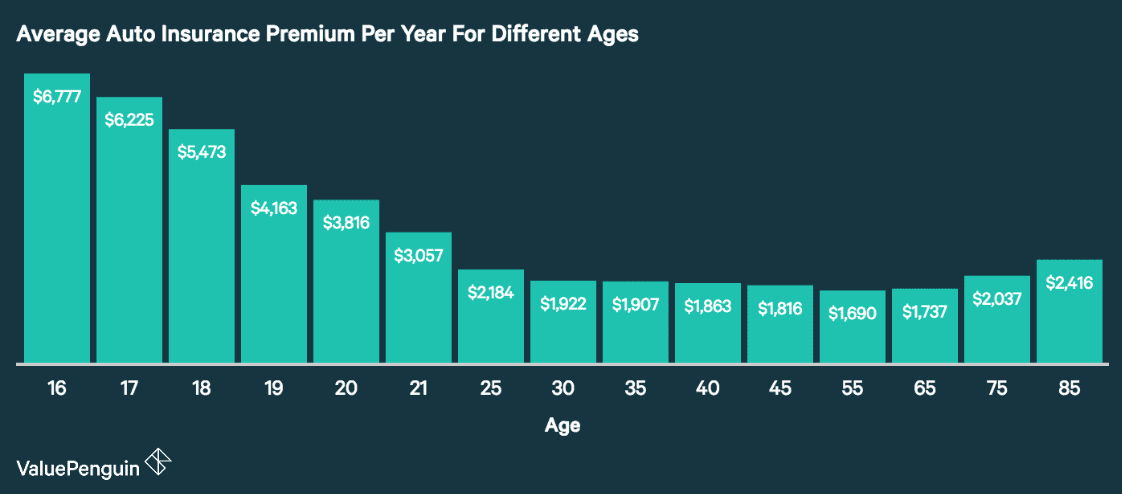

- Age – Overall, premiums are most expensive for teens and least expensive for 50-year-old drivers.

- Years driving – You are less of a risk if you have more driving experience.

- Driving history – A person who has left violations—a DUI, speeding ticket, moving violation, for example – in their wake is more of a risk for the insurance company.

- The car you drive – A less expensive car to repair or replace will give you a better score.

- Where you live – This rating is based on the state and city you’re in. Higher traffic areas will cost more. Locations prone to crime, floods, wildfires and so forth push premiums up, too.

- Credit score – It may surprise you to know that even your credit history plays a role in how you are rated by insurance companies. Premiums can be roughly twice as high if you have a poor credit score.

- Gender – Based on statistics, a female teen-ager will pay less than a male teen.

- Insurance consistency – Teen drivers don’t yet have a steady history of being insured, and that is one reason premiums for young people can be so high. Once you have at least five years of being covered, and have established you’re a good driver, you should start to pay less for premiums.

- Marital status – Your status as single, married, divorced or widowed is taken into account. Data shows that married people submit fewer individual claims, but even if you’re single, the effect on your rates is relatively mild.

- Mileage – How much mileage you put on your car every year goes into your ratings. The less you drive, the lower your premiums will probably be.

Kinds of Auto Insurance New Drivers Need

States have different requirements, including a minimum amount of insurance you must have. You can find out what your state requires with this interactive map.

You should also consider other coverage options:

- Bodily Injury Liability – Protects those injured in an accident that you caused. Most states mandate you have this coverage.

- Collision Coverage – Protects your vehicle in the event it is damaged in an accident. This coverage may be mandated by your lender.

- Comprehensive Coverage – Protects your cars from non-accident events such as damage cause by wildlife.

- Medical Payments or Personal Injury Protection – Covers medical costs for those injured. These types of coverage may be required if you reside in a “no-fault” state.

- Property Damage Liability – Covers damage to another party’s property including their vehicle, home, and so forth.

- Replacement Value Coverage – Will actually pay for replacing your vehicle instead of just its depreciated value.

- Uninsured and Underinsured Motorist Coverage – Protects you in case the at-fault individual does not have insurance, or their coverage limits are too low to compensate you.

Ways to Lower the Cost of Car Insurance

If you’re looking for cheap auto insurance for new and young drivers, be prepared for the fact that “cheap” is relative. While you won’t magically get a policy that’s super low, you may be able to reduce your premium costs.

Join your parents’ policy.

Putting a new driver on the family policy will increase that cost of coverage, but the new driver’s portion will be lower than having separate coverage. By the time you turn 25 you’ll have several years of driving experience to help you bring costs down on your own.

Don’t insist on driving an expensive car.

Generally, the car you get coverage for influences the cost of your policy. While a new car can be safer than an old clunker, an older low-cost or mid-range car that gets a good safety rating can cost less to insure.

Drive a car with safety equipment.

Many cars come with anti-theft devices, from alarms to Lojack services, which track your car in the event of theft. Your insurance company may give you a discount.

Bundle with your renters (or homeowners) Insurance.

If you have renters or homeowners insurance, you may be able to get a better rate for your auto insurance policy if you bundle your policies. Ask your insurance carrier if they offer such a discount.

Keep your grades up.

Many insurers will offer good student discounts to drivers who maintain at least a 3.0 grade point average.

Take a defensive driving class.

A lot of insurance companies will discount a policy if the driver has completed a defensive driving course.

Pay your premium with a one-time payment.

Pay a single, upfront annual premium instead of breaking it up into monthly or quarterly payments, which usually comes with a convenience fee. If you can swing it, you might save between 10% and 15% by making a lump sum payment.

How to Find Cheap Car Insurance for New Drivers

Unless you are on a policy with your parents, you’ll need to shop around for the best coverage for you at the best price. Get at least three quotes to compare. A good way to get started is to use an online quote tool. You’ll then be able to contact your picks, ask questions and make your selection.

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE