How Does Divorce Affect Your Car Insurance?

How Divorce Can Affect Your Car Insurance

How Divorce Can Affect Your Car Insurance

Going through a divorce can be a tough experience, bringing with it some major lifestyle changes. It is a stressful time with a million details to take care of. One item on the divorce to-do list is to get your car insurance policies in order. Let’s see how divorce affect car insurance rates.

Be Prepared for Changes to Your Premium

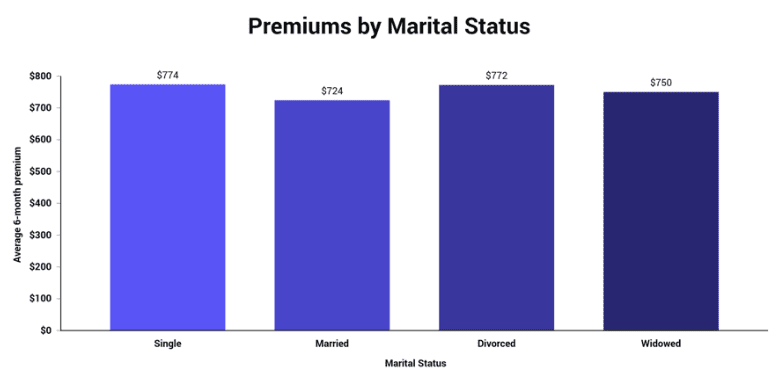

Statistics show that married drivers are less likely to submit claims, so are generally considered low risk to the insurance providers. Chances are good you’ll pay a little bit more as a divorced individual.

Other factors considered by insurance companies when establishing that divorce affect car insurance include:

Marital status

Becoming a divorced single driver can bump your premiums up due to a number of factors.

Where you live

If you move to another area your new location will be factored in. Moving to a city, where there is more crime, car thefts and accidents, usually brings premium costs up compared to moving to a rural area—unless you move to a disaster-prone location, where that could drive up your rates. Also, if you move out of state, be sure to get to know your new home state’s requirements including minimum coverage allowed.

Your personal driving record

Once you are divorced, your record is the only one considered by your insurer when determining your premium cost. The fewer dings, the less you’ll pay on average. This includes any ticketed violations you receive as well as number of claims you’ve filed.

Your credit score

Based on data, your credit rating makes a difference, too. There are correlations between good credit/less risk and bad credit/more risk.

Your demographics

Insurers take various demographics into consideration when determining risk factors. For example, age (young drivers are higher risk) and gender (females pay lower premiums because data show that women drivers are lower risk).

Multiple driver and multiple policy discounts

You could lose certain discounts once you’re divorced. You may be the only driver on your policy, for instance. Perhaps you no longer own a home and don’t qualify for a multi-policy discount. If possible, bundle your auto insurance policy with other insurance you own, such as home insurance if you own a home, to receive a discount.

How to Separate Auto Insurance After Divorce

Ultimately, there are several changes that will need to be made:

- Obtain individual car insurance policies.

- Make sure the named insured for a car is on that car’s title.

- Ensure that your teen drivers are covered.

Certain steps that can’t be taken until a divorce is finalized, but be prepared by keeping the following in mind throughout the process:

- Get individual car insurance policies. One of you will be able to keep the “old” policy while the other must purchase new car insurance. You can’t remove the other’s name or vehicle from an existing policy without their consent. It’s a rare occasion, an insurer may offer to split an existing policy for a couple into two separate policies.

- Establish separate living arrangements. Start separating liability responsibilities by living at separate addresses. You’ll need to do this before splitting up your car insurance policies.

- Be sure the insured’s name is on the car’s title. Most insurance providers require that whoever is insuring a car is shown on its title. Each person’s name should be on the title of the car he or she is driving following a divorce.

- Get a new policy prior to being removed from the old one. Whoever needs to get a new car insurance policy should do so before their name is removed from the preexisting policy.

- Remember: You can’t remove someone’s name from a policy without consent. Ideally, this will be discussed up front, but it’s best to submit a signed removal request form to the insurer. This generally happens when a divorce is finalized.

Your Driving Teen’s Coverage After a Divorce

Even youthful drivers’ coverage is affected by a divorce. Usually, the teen is named as a driver with the parent who has primary custody. Although teens can get their own insurance policy, it will be more expensive for them and their name must be on the car’s title. Whether it’s you, your ex or your teen, the divorce agreement should indicate who pays for the insurance.

Regarding Reconciliation

Do yourself and your insurance company or broker a favor: wait until your divorce is final before executing key changes you’ll need to make. If you reconcile after a divorce is all but complete, you’ll need to re-do many steps and re-combine policies. If you received approval and have removed your spouse from your auto insurance policy before reconciling, for instance, this will need to be changed back.

How to Get a New Car Insurance Policy

If you find yourself in the position of needing an individual policy, shop around to ensure you get the best coverage for you, at the best price. You can contact insurers or brokers individually to get quotes, or you can use an online tool to simplify the process. EINSURANCE will give you a number of quotes based on the details you provide. You can also learn more about the ins and outs of car insurance. A chat desk is available to answer any questions you may have, or call (866) 845-3808 for more information.

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE